Still unsure? Answer a few questions to find the entity that’s right for you. Assistance me make your mind up

The way it's exceptional Greater for max flexibility in the way you deal with and run your business; board of administrators not required

Go by a unique business name without having developing a new company. Above 50 percent of our DBA customers are sole proprietors. Start off my DBA

No illustration is produced that the caliber of the authorized services to become carried out is larger than the standard of lawful solutions carried out by other legal professionals.

We will not warranty particular legal outcomes once you use our merchandise or expert services. One example is, a trademark software is likely to be loaded out correctly but nonetheless get turned down by The federal government for motives over and above our Handle. We could only refund our cost for issues we're directly accountable for.

No podemos garantizar resultados legales específicos cuando usted United states of america nuestros productos o servicios. Por ejemplo, es posible que una solicitud de marca comercial se realice correctamente y aun así el gobierno la rechace por motivos ajenos a nosotros. Solo podemos reembolsar nuestro arancel por cuestiones de las que seamos directamente responsables.

Get every one of the essentials, all in a single spot. No matter whether it’s an working settlement, registered agent, business licenses—even tax and lawful assistance—that you choose to need, get them all any time you file with us. Commonly requested queries What's the distinction between an LLC and also a corporation?

We do proper by you—so we are going to refund our charge in the to start with 60 days of acquire if you're unsatisfied with our products and services. Get in touch with or electronic mail us, and we are going to process your refund within just five business days.

Regardless that LLCs are regarded much easier to get started and maintain, investors have a tendency to desire corporations. What is the distinction between a C corporation and an S corporation?

Private liability defense. An LLC safeguards homeowners from currently being personally within the hook for business liabilities or debts. A sole proprietorship will not. How are diverse business styles taxed?

Equally defend homeowners so they're not Individually to the hook for business liabilities or debts. But, critical variations include things like how they're owned (LLCs have one or more individual owners and corporations have shareholders) and managed (corporations commonly have far more formal record-keeping and reporting necessities).

LLCs, S corporations, and sole proprietorships are taxed at the time on income received. C corporations are taxed two times; the business pays taxes at the corporate stage, and shareholders spend taxes on profits obtained. Which business styles give me personalized legal responsibility safety?

Their knowledgeable personnel answered all my questions without the need of hesitation, and understood the many avenues to get my demands achieved." Lori Nayehalski, corporation customer

No podemos reembolsar los costos de procesamiento de terceros (por ejemplo, los montos abonados directamente a nuestros socios de servicios o para facilitar el cumplimiento de su pedido, como los gastos de envío) una vez LLC Lookup Georgia efectuada la compra.

Heading solo or teaming up? Be sure to're not about the hook for business liabilities by having an LLC. Get yours started off without spending a dime—just pay back state submitting expenses. Start out my LLC

Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Jurnee Smollett Then & Now!

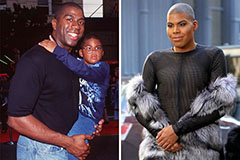

Jurnee Smollett Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!